The fascination with treasured metals, notably silver and gold, spans centuries and cultures, serving as a medium of change, a retailer of worth, and a symbol of wealth. This case research explores the historic significance, financial roles, and investment potential of silver and gold, offering insights into why these metals proceed to capture the interest of investors and collectors alike.

Historic Significance

Gold has been revered since historical occasions, with its use dating again to around 3000 BC in Egypt. It was not only used for jewellery and decoration but in addition turned a normal for forex. The well-known King Tutankhamun’s burial mask illustrates the metal’s significance in historical civilizations. Gold’s rarity and luster made it a perfect candidate for coins, and it turned the idea of many economies until the 20th century when the gold customary was abandoned.

Silver, then again, has a barely completely different history. It was used in trade as early as 4000 BC and became the first steel to be minted into coins in 600 BC by the Lydians. Silver held a significant role in varied cultures, including the Greeks and Romans, who utilized it for trade and as a form of foreign money. Each metals have been intertwined with human historical past, influencing economies and societies profoundly.

Financial Roles

In trendy economies, gold and silver serve completely different however complementary roles. Gold is commonly considered as a “protected haven” asset, particularly in times of economic uncertainty. Its worth tends to rise when stock markets fall, making it a lovely choice for buyers trying to hedge towards inflation and currency devaluation. As an illustration, in the course of the 2008 monetary disaster, gold prices surged as investors flocked to the steel for security.

Silver, whereas additionally thought-about a safe haven, has a extra advanced function. It isn’t solely an funding asset but in addition an industrial metallic. Roughly 50% of silver demand comes from industrial purposes, including electronics, photo voltaic panels, and medical devices. This duality gives silver a novel position out there, where its price might be influenced by each economic situations and technological developments.

Funding Potential

Investing in gold and silver might be approached in varied ways, together with physical possession, trade-traded funds (ETFs), mining stocks, and derivatives. Each technique has its advantages and drawbacks.

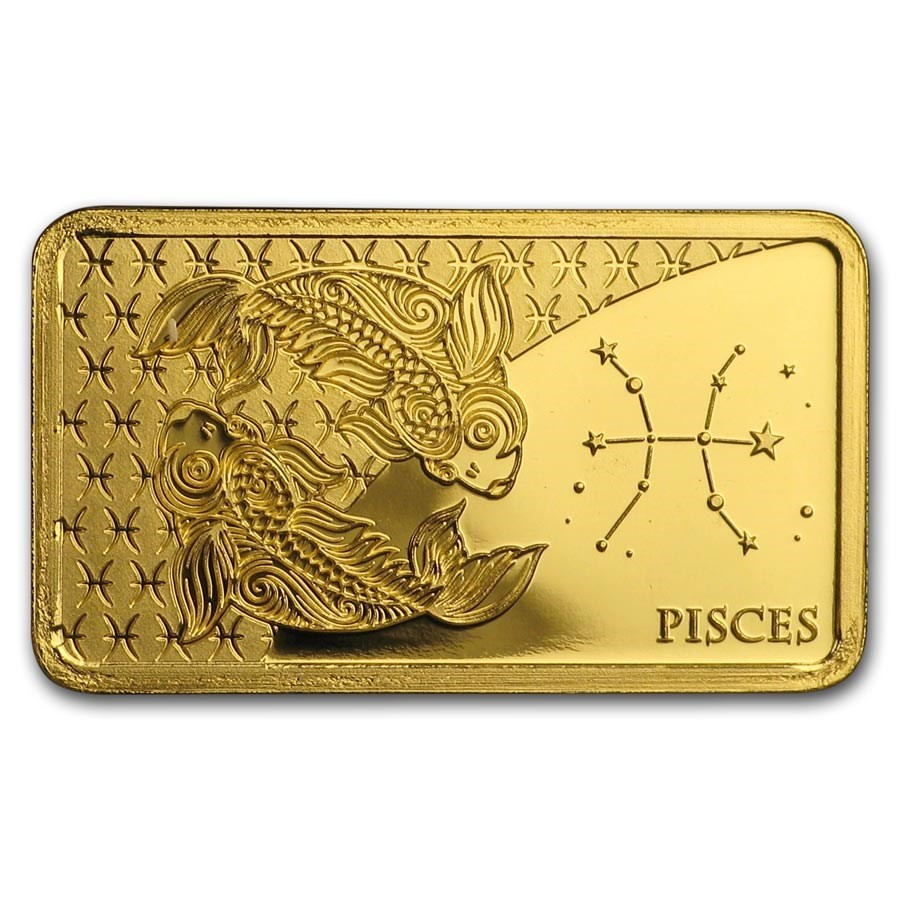

- buy physical gold online Possession: Many investors choose to hold bodily gold and silver within the type of coins or bars. This tangible asset provides a sense of security, as it is not subject to counterparty risk. However, physical metals require storage and insurance coverage, which may add to the price of funding.

- Exchange-Traded Funds (ETFs): Gold and silver ETFs supply a handy option to put money into these metals with out the necessity for bodily storage. These funds track the price of the metals and will be purchased and offered like stocks. They supply liquidity and ease of entry, however traders must consider administration fees and the potential for tracking errors.

- Mining Stocks: Investing in mining corporations can provide publicity to gold and silver costs while additionally providing the potential for capital positive factors by firm efficiency. Nevertheless, mining stocks are topic to operational dangers, including administration decisions, labor strikes, and geopolitical issues.

- Derivatives: Futures and choices contracts enable traders to speculate on the longer term prices of gold and silver. Whereas these instruments can supply excessive returns, in addition they include significant dangers and require a deep understanding of market dynamics.

Market Dynamics

The costs of gold and silver are influenced by varied components, including supply and demand, geopolitical stability, and macroeconomic indicators. If you have any inquiries relating to in which and how to use Https://advokatsthlm.se/, should you buy gold online can get in touch with us at our web site. For gold, central financial institution insurance policies play a vital position. Central banks hold significant reserves of gold and may influence its value by way of buying and promoting activities. In contrast, silver’s worth is more sensitive to industrial demand, making it susceptible to financial cycles.

Lately, the rise of digital currencies and alternative investments has posed challenges for gold and silver. However, many buyers nonetheless view valuable metals as a dependable retailer of value, significantly in occasions of crisis. The COVID-19 pandemic, for instance, led to increased interest in gold and silver as buyers sought to guard their wealth amid economic uncertainty.

Conclusion

The enduring worth of silver and gold is a testomony to their historic significance and economic roles. Whereas gold remains an emblem of wealth and a safe haven asset, silver’s dual nature as both an funding and an industrial metal adds complexity to its market dynamics. As traders navigate the challenges of modern economies, the allure of these valuable metals continues to shine brightly.

In abstract, silver and gold are more than simply metals; they’re integral elements of the global financial system and funding landscape. Their historic legacies, economic roles, and funding potentials be sure that they may stay related for generations to come back. Understanding the nuances of every metal can empower investors to make knowledgeable choices of their pursuit of wealth preservation and growth.